School of Business hosts a seminar on: “Access to Finance for Small and Medium Enterprises” in partnership with the International Monetary Fund and Economic Research Forum

On February 12, a seminar organized in partnership with The International Monetary Fund (IMF) and the Economic Research Forum (ERF) was held at the Tahrir Square Campus. The seminar titled “Access to Finance for Small and Medium Enterprises”, was attended by 120 participants from various backgrounds and organizations including economists, researchers, AUC faculty and staff, and media representatives.

The event launched the IMF Report Scaling Up Access to Finance for Small and Medium Enterprise in the Middle East and North Africa which highlighted the macroeconomic relevance of financial inclusion and calling for a holistic approach to financial inclusion strategies.

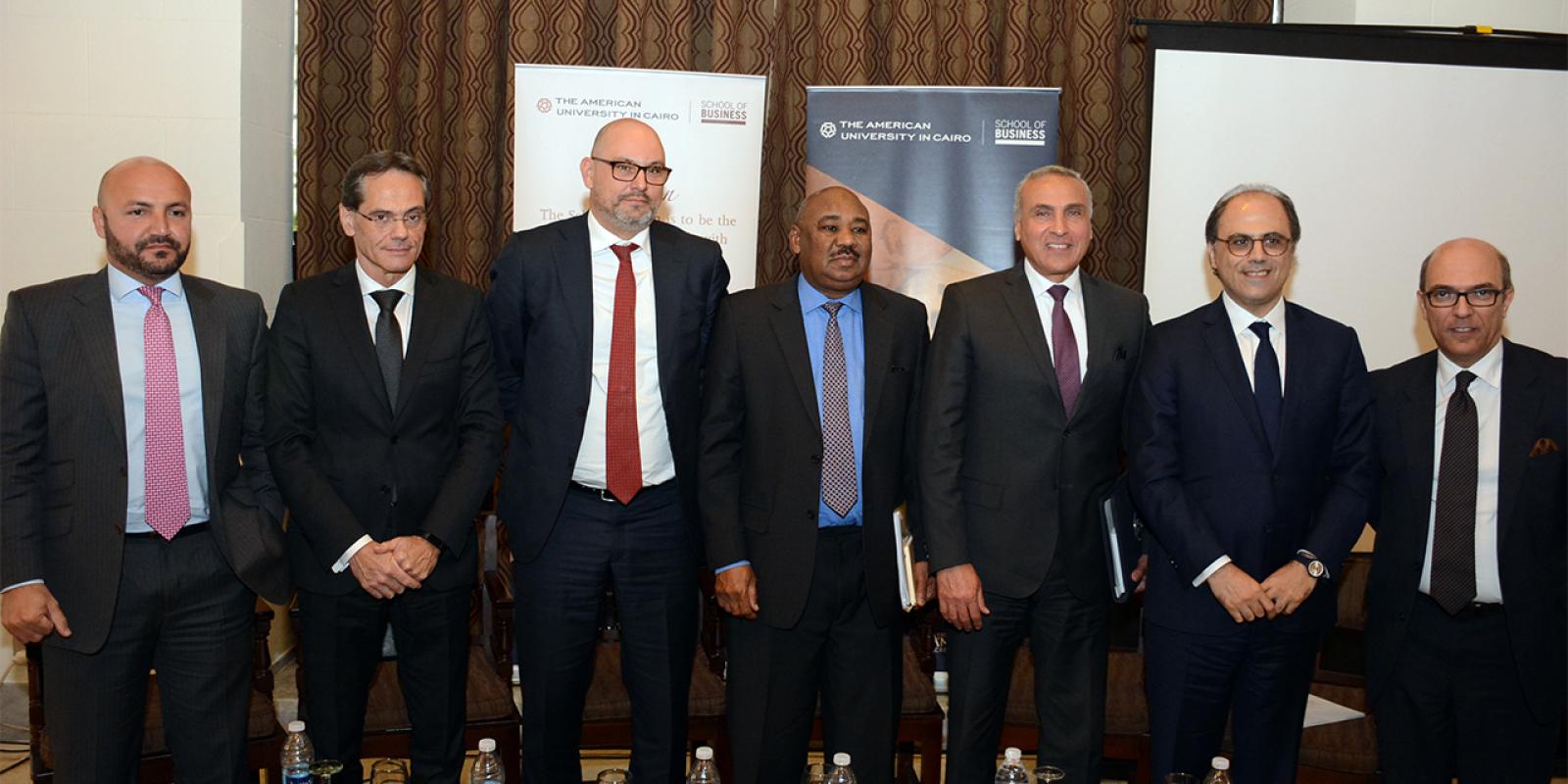

The event included a presentation on the report findings by Nicholas Blancher, IMF advisor of the Middle East and Central Asia Department. Blancher followed by a panel discussion moderated by Jihad Azour, IMF director of the Middle East and Central Asia Department.

In his presentation, Blancher mentioned: “SMEs are the backbone of economic growth and job creation; they represent more than 95% of the all business in the region and employ 50% of its workforce, yet they only get 7% of total lending.”

Panel speakers included: Gamal Negm, deputy governor of the Central Bank of Egypt, Holger Wiefel, regional head for SME Finance and Development at the European Bank for Reconstruction and Development, Ibrahim ElBadawi, director of the Economic Research Forum, Dante Campioni, CEO of Alexbank, and Sam Quawasmi, CEO of Eureeca.

The panel discussions touched on how SME financial inclusion lies at the heart of economic diversification, growth, and job creation challenges that many countries are facing today, particularly in the MENA region, which falls behind other regions in terms of SME access to finance.

Following the discussion event participants shared fruitful discussions with panelists on several issues including: competing in financing, subsidies and the distorted interest rate system, banking credit, the economic differences between medium and small enterprises, whether micro and small enterprises need financing versus marketing, the importance of institutional and regulatory support for SME’s, and the necessity of education and knowledge about capitalization and raising money.

On the reason Egypt was the chosen for the launch of the report, Jihad Azour remarked “other than that it is the heart of Africa, the Egyptian economy is one with a lot of talents and is, in fact, working on all the discussed issues and has been making a lot of effort to address its challenges in the last years, and this makes it a perfect economy to start with. The choice of Egypt was obvious for us.”

Following the event, Azour gave an exclusive interview to Business Forward on Egypt’s macroeconomic outlook and the status of SMEs in Egypt, which will be published very soon.

The full seminar is available now on our channel: https://youtu.be/Oai4tzPBUtg